This program is designed for professionals and learners who want to apply prompt engineering to real-world finance investment analysis using AI-driven insights and practical workflows.

Prompt Engineering for Finance Investment Analysis

With

Certification & 100% Placement Assistance

Online & Classroom Training | 1-Month Structured Program | Hands-On Real-Time Projects

Our Prompt Engineering for Finance & Investment Analysis program focuses on practical financial workflows, real-world investment case studies, and industry-relevant AI use cases to help analysts and investors generate insights, evaluate risks, automate financial analysis, optimize portfolio decisions, and build strong career opportunities in the finance domain.

Batch Details

Details | Information |

Trainer Name | Ms. Pushkara Seelam |

Trainer Experience | 3+ Years of Real-Time Industry Experience |

Next Batch Date | 11 December 2025 |

Training Modes | Online & Offline Training |

Course Duration | 1 Month |

Call Us At | +91 81868 44555 |

Email Us At | promptacademy.in@gmail.com |

Demo Class Details | Enroll for Free Demo Class |

Menu

Prompt Engineering Course in Hyderabad

Course Curriculum

1. What is prompt engineering in finance investment analysis

It teaches how to design AI prompts to analyze financial data, evaluate investments, generate insights, and support informed decision-making.

2. Why is prompt engineering important for finance professionals

It enables faster analysis, accurate insights, reduced manual effort, and better use of AI for financial research and planning.

3. What financial fundamentals are covered in this course?

The course covers financial statements, ratios, valuation basics, market concepts, and investment risk fundamentals.

4. How does the course teach financial data analysis prompts

Learners practice prompts that summarize datasets, interpret trends, compare metrics, and highlight actionable insights.

5. Does the curriculum include stock market analysis prompts

Yes, it covers prompts for stock screening, trend analysis, performance comparison, and market sentiment evaluation.

6. How are prompts used for investment research

Students learn prompts to analyze company profiles, financial health, growth potential, and competitive positioning.

7. Does the course cover portfolio analysis using prompts

Yes, it includes prompts for portfolio diversification, risk assessment, asset allocation, and performance review.

8. How does prompt engineering support risk analysis

Prompts help identify risks, evaluate volatility, analyze scenarios, and generate risk mitigation insights.

9. Are financial statement analysis prompts included

Yes, learners create prompts to analyze balance sheets, income statements, and cash flow reports clearly.

10. How does the course handle market trend analysis

It teaches prompts that track macro trends, sector movements, and economic indicators affecting investments.

11. Does the curriculum include valuation model prompts

Yes, prompts are used to support valuation logic, assumptions review, and comparative valuation analysis.

12. How are prompts applied to investment decision-making

Students learn to generate AI-supported summaries, comparing options and recommending data-backed decisions

13. Is prompt engineering useful for financial forecasting

Yes, the course teaches prompts to analyze historical data and generate forecasting insights and assumptions.

14. Does the course include mutual fund analysis prompts

Yes, it covers prompts for fund comparison, returns analysis, expense review, and risk profiling.

15. How are real-world finance use cases included

The curriculum includes practical scenarios using real financial datasets and investment analysis examples.

16. Are compliance and ethical finance prompts covered

Yes, learners practice prompts aligned with compliance, disclosures, and ethical investment considerations

17. Does the course include reporting and presentation prompts

Yes, it teaches prompts for generating investor reports, summaries, and presentation-ready insights.

18. How does the course improve analytical thinking

Structured prompting enhances logical reasoning, financial interpretation, and clarity in investment analysis.

19. Who should enroll in this finance and engineering course

Finance students, analysts, investors, bankers, and professionals seeking AI-powered financial skills.

20. What outcomes can learners expect after completing this course

Learners gain practical AI skills to analyze investments faster, reduce errors, and improve financial decision quality.

Prompt Engineering Course Trainer Details

INSTRUCTOR

Ms. Pushkara Seelam

Expert & Lead Instructor

3+ Years Experience

About the Tutor:

Ms. Pushkara Seelam is a dedicated trainer for the Prompt Engineering Course, bringing over 3+ years of hands-on industry and training experience in AI-driven workflows and prompt design. She specializes in teaching how to communicate effectively with AI tools and large language models, helping learners build clarity and confidence in prompt engineering.

With a practical, project-oriented teaching approach, Ms. Pushkara ensures that students gain industry-relevant skills by working on real-world prompt engineering use cases. Her training covers foundational concepts, advanced prompt strategies, and applied AI workflows used in professional environments.

Beyond technical instruction, Ms. Pushkara actively supports learners with resume preparation, mock interviews, and career guidance, helping them transition smoothly into AI-focused roles and Generative AI career paths.

Prompt Engineering for Finance Investment Analysis

Why choose us?

- Industry-focused prompt training for finance professionals

- Learn AI-driven investment research and decision workflows.

- Practical prompts for stocks, crypto, and portfolio analysis

- Designed for finance professionals and investment beginners

- Hands-on training with real financial use cases

- Prompts tailored for risk analysis and market trends

- Improve

- Practical assignments to build finance-ready portfolios

- Automation prompts to speed up financial research

- Updated syllabus aligned with finance AI trends

- AI tools for equity, crypto, and forex analysis

- Productivity-focused prompts for analysts and planners

- Expert mentors with real investment industry experience

- Career-focused training for finance and analysis roles

What is Prompt Engineering for Finance Investment Analysis

Prompt engineering for finance investment analysis is the practice of writing clear, structured, and data-driven instructions that help AI support analysts, investors, and finance professionals across the entire investment lifecycle. Instead of performing every analysis manually, professionals use prompts to guide AI in generating accurate, reliable, and insight-driven financial outputs.

As AI-driven finance becomes mainstream, prompt engineering is a must-have skill for investors who want to stay analytical, risk-aware, and competitive in modern markets.

- Financial data analysis and interpretation

- Stock, crypto, and asset research

- Risk assessment and portfolio insights

- Market trend and forecast analysis

- Investment reports and decision support

At Prompt Academy, we focus on prompt engineering specifically tailored for Finance Investment Analysis use cases, including:

Where Prompt Engineering for Finance Investment Analysis

Area of Use | How Prompt Engineering Is Applied | Example Use Case |

Market Research | Prompts analyze market trends and macroeconomic data | “Summarize current equity market trends with risks and opportunities.” |

Stock Analysis | AI evaluates financial statements and ratios | “Analyze this company’s balance sheet and highlight investment risks.” |

Portfolio Management | Prompts optimize asset allocation strategies | “Suggest a diversified portfolio for moderate risk investors.” |

Risk Assessment | AI identifies financial and market risks | “List potential risks affecting this stock in the next 12 months.” |

Financial Forecasting | Prompts generate revenue and growth projections | “Predict revenue growth based on the past five years’ data.” |

Investment Reports | AI drafts structured investment summaries | “Create an investment report for this mutual fund.” |

Technical Analysis | Prompts explain chart patterns and indicators | “Explain RSI and MACD signals for this stock.” |

Fundamental Analysis | AI evaluates company fundamentals | “Analyze the competitive advantages of this company.” |

News Impact Analysis | Prompts assess news impact on markets | “Explain how this news may affect stock prices.” |

Earnings Call Analysis | AI summarizes earnings call transcripts | “Summarize key insights from this earnings call.” |

Valuation Modeling | Prompts assist the valuation logic explanation | “Explain DCF valuation assumptions in simple terms.” |

Sentiment Analysis | AI analyzes investor sentiment | “Analyze market sentiment from recent financial news.” |

Mutual Fund Analysis | Prompts compare fund performance | “Compare two mutual funds based on returns and risk.” |

Crypto Investment Analysis | AI evaluates crypto market trends | “Analyze Bitcoin market trend and volatility.” |

ESG Investing | Prompts assess sustainability factors | “Evaluate ESG risks of this company.” |

Benefits of Prompt Engineering for Finance Investment Analysis

Prompt Engineering for finance investment analysis helps professionals extract accurate insights from financial data using AI. It improves forecasting, risk evaluation, portfolio planning, and decision-making speed. By using structured prompts, investors can analyze trends, compare assets, generate reports, and reduce manual effort while improving consistency, accuracy, and strategic clarity in investment analysis workflows.

1. Faster financial insights?

Enables quick analysis of large financial datasets accurately.

2. Improved risk assessment?

Helps identify risks using structured AI-driven evaluation methods.

3. Better investment decisions?

Supports data-backed decisions with clear analytical outputs.

4. Automated financial reporting?

Generates summaries, forecasts, and reports without manual work.

5. Enhanced market trend analysis?

Identifies patterns and trends across global financial markets.

6. Portfolio optimization support?

Assists in balancing assets for better returns.

7. Reduced analysis errors?

Minimizes human mistakes through consistent AI prompts.

8. Time and cost efficiency?

Saves analyst time and reduces operational costs.

9. Scalable investment workflows?

Adapts easily to growing data and investment complexity.

Prompt Engineering for Finance Investment Analysis

Skills Developed After the Course

- AI-driven financial data interpretation accuracy.

- Advanced prompt design for investment research

- Automated market trend and risk analysis skills

- Portfolio performance insights using AI prompts

- Faster financial report summarization techniques

- Decision-making support with predictive analysis

- Enhanced accuracy in forecasting investment returns

- Structured prompts for valuation and benchmarking

- Time-saving workflows for finance analysis tasks

- Strategic thinking using AI-driven insights tools

- Risk assessment optimization through smart prompts

- Professional readiness for finance AI roles careers

Prompt Engineering for Finance Investment Analysis

Certifications

Prompt Engineering for finance investment analysis trains professionals to use AI for smarter insights, risk evaluation, forecasting, and data-driven decisions with industry-recognized certifications from Prompt Academy.

- Learn AI prompts for accurate financial data analysis.

- Build smarter investment forecasts using structured prompts.

- Improve risk assessment with AI-driven prompt strategies.

- Gain certification focused on real-world finance use cases.

- Boost career value with prompt skills for finance roles.

Prompt Engineering for Finance Investment AnalysisFee & Offerings in Hyderabad

Course Fees & Offerings

Video Recording

- Lifetime video access

- Basic to advanced prompts

- 70+ recorded classes

- One capstone project

- Resume and interview support

- Placement assistance provided

- WhatsApp learning group

Class Room Training

- 1 month of classroom training

- Expert prompt engineering trainers

- Real-time prompt projects

- One-on-one mentor support

- Monthly mock interviews

- Resume building & interview guidance

- Soft skills & aptitude training

- Dedicated placement officer

- Commute support (offline batches)

- WhatsApp support group

Online Course

- Live interactive prompt classes

- 1 month duration

- Daily session recordings

- Real-time project environment from Day 1

- Weekly mock interviews

- Dedicated doubt-clearing sessions

- 50+ sample resumes access

- WhatsApp learning group

EMI Available for modes. (Classroom Training – Online Course )

Prompt Engineering Course In Hyderabad

Testimonials

“Prompt engineering helped me analyze financial reports faster and make more confident investment decisions using AI.”

sai babu

“Learning prompt engineering improved my ability to extract clear insights from complex investment data efficiently.”

manikanta

“This training showed how AI prompts simplify portfolio analysis and risk evaluation for smarter investments.”

teja

“Prompt engineering skills enabled me to automate market research and focus on strategic investment planning.”

kerthana

“The course helped me use AI prompts for financial forecasting and scenario analysis with better accuracy.”

vijai

“The course helped me use AI prompts for financial forecasting and scenario analysis with better accuracy.”

pavani

“Prompt engineering enhanced my equity research by generating structured insights from large financial datasets.”

mahesh

“Learning prompt engineering helped me interpret market trends and financial ratios more clearly.”

ramana

“Prompt engineering empowered me to make data-driven investment decisions faster using intelligent AI workflows.”

Devika

have A Look at us

We can help you achieve your professional goals

Our instructors are experts in Prompt Engineering for Finance Investment Analysis, with years of hands-on experience working with LLMs and financial data models. They are passionate about teaching analysts and investors how to use AI prompts to analyze markets, evaluate risks, generate insights, and make data-driven investment decisions efficiently.

Prompt Engineering for Finance Investment Analysis - Our Great Achievements

Active Students

0

+

Courses

0

+

Expert Trainers

0

+

Batches

0

+

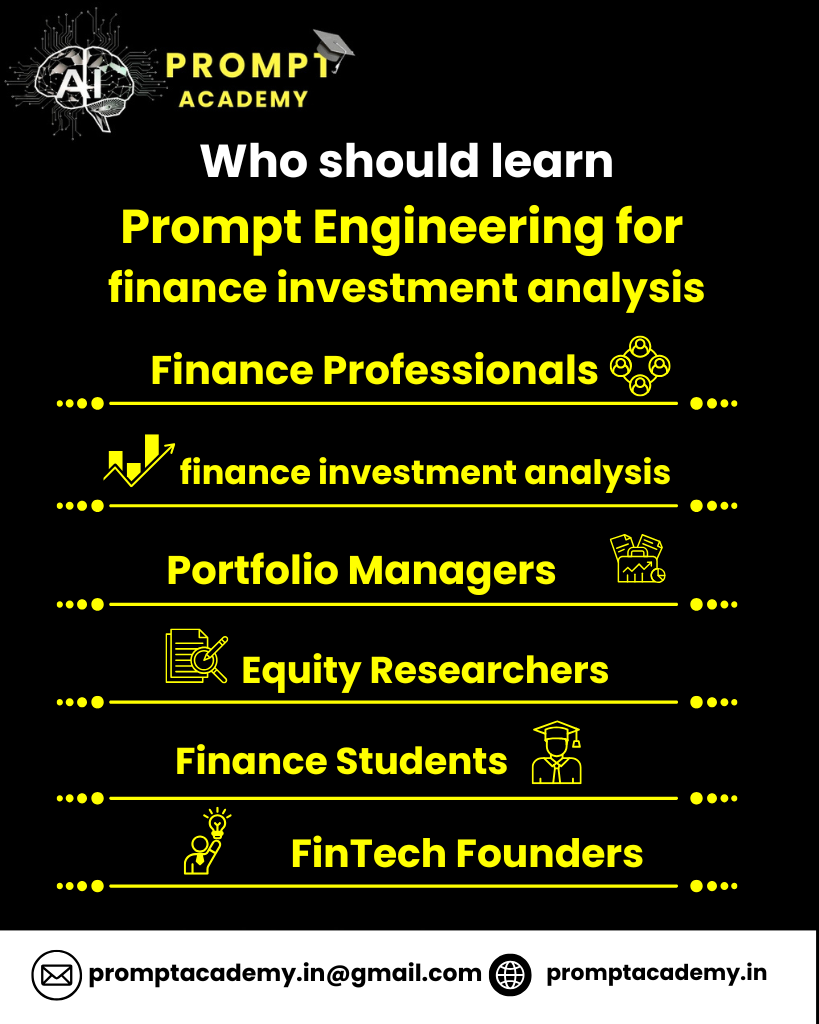

Prompt Engineering for Finance Investment Analysis

Who Should Join

- Finance professionals seeking AI-driven insights to improve portfolio analysis, forecasting risk assessment, and investment decision accuracy.

- Equity research analysts want faster data interpretation, automated reports, and smarter valuation models using prompts for daily workflows.

- Investment advisors aiming to personalize recommendations generate market summaries and communicate insights clearly to clients with confidence.

- Finance students and MBA graduates are building practical AI skills for modern investment analysis roles across markets globally.

- Portfolio managers looking to automate scenario analysis, stress testing, and data-driven decision workflows efficiently at scale.

- Entrepreneurs and fintech founders are exploring AI prompts to evaluate opportunities, manage risk, and plan investments strategically in the long term.

Prompt Engineering for Finance Investment Analysis

Careers Opportunities

- AI Investment Analyst roles leverage prompt engineering to generate market insights, forecasts, and scenario analyses rapidly and efficiently.

- Prompt engineers in finance support portfolio managers by automating research summaries, risk assessments, and asset comparisons efficiently.

- Quantitative research assistants use prompt engineering to explore datasets, test hypotheses, and explain complex financial models clearly.

- Fintech product analysts apply prompt engineering to design AI-driven tools for investment analysis and decision support systems.

- Risk management professionals leverage prompt engineering to simulate market stress scenarios and identify potential portfolio exposures early.

- Equity research associates use prompt engineering to draft reports, compare companies, and summarize earnings calls quickly and accurately.

- Wealth management advisors apply prompt engineering to personalize investment recommendations and client communication at scale efficiently and securely.

- Financial data analysts use prompt engineering to clean datasets, generate insights, and visualize investment trends clearly and faster.

- Compliance and audit professionals leverage prompt engineering to review financial documents and flag regulatory risks proactively and consistently.

- Career paths include AI finance consultants designing prompt strategies for investment firms and financial institutions globally today.

Prompt Engineering for Finance Investment AnalysisSalary in Hyderabad – Freshers to Experienced

Experience Level | Years of Experience | Average Salary Range (₹/Year) | Key Responsibilities |

Freshers | 0 – 1 Year | ₹4 L – ₹6 L | Writing basic prompts for financial data analysis, reports, and market summaries |

Junior Level | 1 – 3 Years | ₹6 L – ₹9 L | Optimizing prompts for investment insights, risk analysis, and portfolio summaries |

Mid-Level | 3 – 5 Years | ₹9 L – ₹14 L | Advanced prompt workflows for forecasting, financial modeling, and decision support |

Senior Level | 5+ Years | ₹14 L – ₹22 L+ | Leading AI-driven investment analysis, strategy prompts, and automation frameworks |

FAQ,s

1. What is prompt engineering for product management?

It is writing clear AI instructions to support product planning, research, documentation, and faster decision-making.

2. Why should product managers learn prompt engineering?

It saves time, improves clarity, and helps PMs generate insights, ideas, and documents efficiently.

3. How does prompt engineering help product strategy?

It helps analyze markets, competitors, and user needs to shape better product strategies.

4. Can prompt engineering support user research?

Yes, it summarizes interviews, creates personas, and extracts insights from user feedback.

5. Is coding required for prompt engineering?

No, product managers only need structured thinking and clear communication.

6. Which PM tasks use prompt engineering the most?

PRDs, roadmaps, user stories, release notes, and stakeholder updates

7. Can prompts help write PRDs faster?

Yes, AI prompts draft clear requirements and acceptance criteria quickly.

8. How does prompt engineering improve roadmap planning?

It helps prioritize features, compare impact, and organize timelines efficiently.

9. Is prompt engineering useful for stakeholder communication?

Yes, it creates concise summaries, reports, and presentations for stakeholders.

10. What tools support prompt engineering for PMs?

AI tools like ChatGPT, Gemini, and product AI assistants support prompt workflows.

11. Can beginners learn prompt engineering easily?

Yes, beginners can learn the basics quickly with simple frameworks and practice.

12. How long does it take to learn prompt engineering?

Basic skills can be learned in days, while mastery grows with real projects.

13. Does prompt engineering replace product managers?

No, it supports PMs by automating tasks while humans drive strategy.

14. Can prompt engineering improve team collaboration?

Yes, it helps create clear briefs and shared understanding across teams.

15. How does prompt engineering help decision-making?

It summarizes data, compares options, and highlights risks clearly.

16. Is prompt engineering useful for backlog management?

It helps refine stories, prioritize tasks, and reduce ambiguity

17. Can prompts analyze product metrics?

Yes, AI prompts summarize KPIs, trends, and performance insights.

18. What skills improve prompt engineering results?

Product thinking, clarity, analytical skills, and stakeholder awareness

19. Is prompt engineering scalable for product teams?

Yes, it adapts easily as product complexity and team size grow.

20. Is prompt engineering future-ready for product managers?

Yes, AI-driven product tools make it a critical PM skill.

Prompt engineering for Software Developers Tools

Prompt engineering for Software Developers Prompt Templates